Mobile wallets have failed so far because they haven’t offered customers a strong enough incentive to use them versus cards. The exception, Starbucks, offers free coffee, but it did that with its gold cards too.

LevelUp, into which Chase poured $10 million in December, offers its loyalty-heavy solution to merchants as well — spend $50, get $5 of free coffee (or whatever).

A presentation at the Banksocial conference this week presented the following idea for getting more data from customers:

@Onovative tip: send out a postcard/email after onboarding & offer a $5 credit for email/social media info. #growthhacking #banksocial

— Social Media Claudia (@hashtagityo) April 3, 2017

But a recent survey by Aite Group and authentication firm Iovation suggests this strategy may not work across other areas of banking — the survey looks at authentication methods and customers’ willingness to try new ones — or at least, it won’t work for everyone.

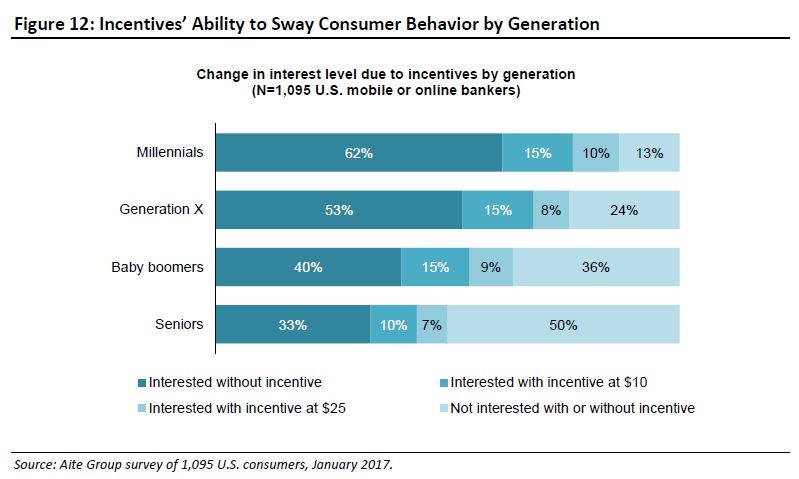

“Customers can be bought,” according to the survey, but it must be the right offer at the right time to the right customer. 51% of participants in the survey of about 1,000 bank customers would be willing to try new authentication methods with no incentives at all. 25% would not be swayed by any incentive the bank was willing to offer. 15% were swayed by an offer of $10, and a further 9% held out for $25.

As might be predicted, cash-strapped millennials are the most receptive to incentives, and seniors (the least likely to try out new authentication methods in any case) the least. In the graph below the incentives are the narrow bands in the middle.

With older customers, aging out of the banking system (and everything else), incentives should be an increasingly powerful way to sway customer behavior, assuming millennials don’t outgrow the need for a quick $10.